You can file your tax return yourself, using tax return or financial administration software, or via a tax intermediary. It is possible to apply for an extension. You can find the form in the encrypted environment of the website, Mijn Belastingdienst (only in Dutch), from 1 March.įile your income tax return before 1 May. You have to file your income tax return digitally. The Tax Administration uses the return to determine your tax assessment: will you have to pay tax, or get a tax refund? File your tax return correctly and before 1 May You must file your income tax return with the Dutch Tax and Customs Administration before 1 May of each year. If your legal structure is a bv, nv, or other legal entity, you file a return for corporate income tax. If your legal structure is eenmanszaak or vof, you file an income tax return.

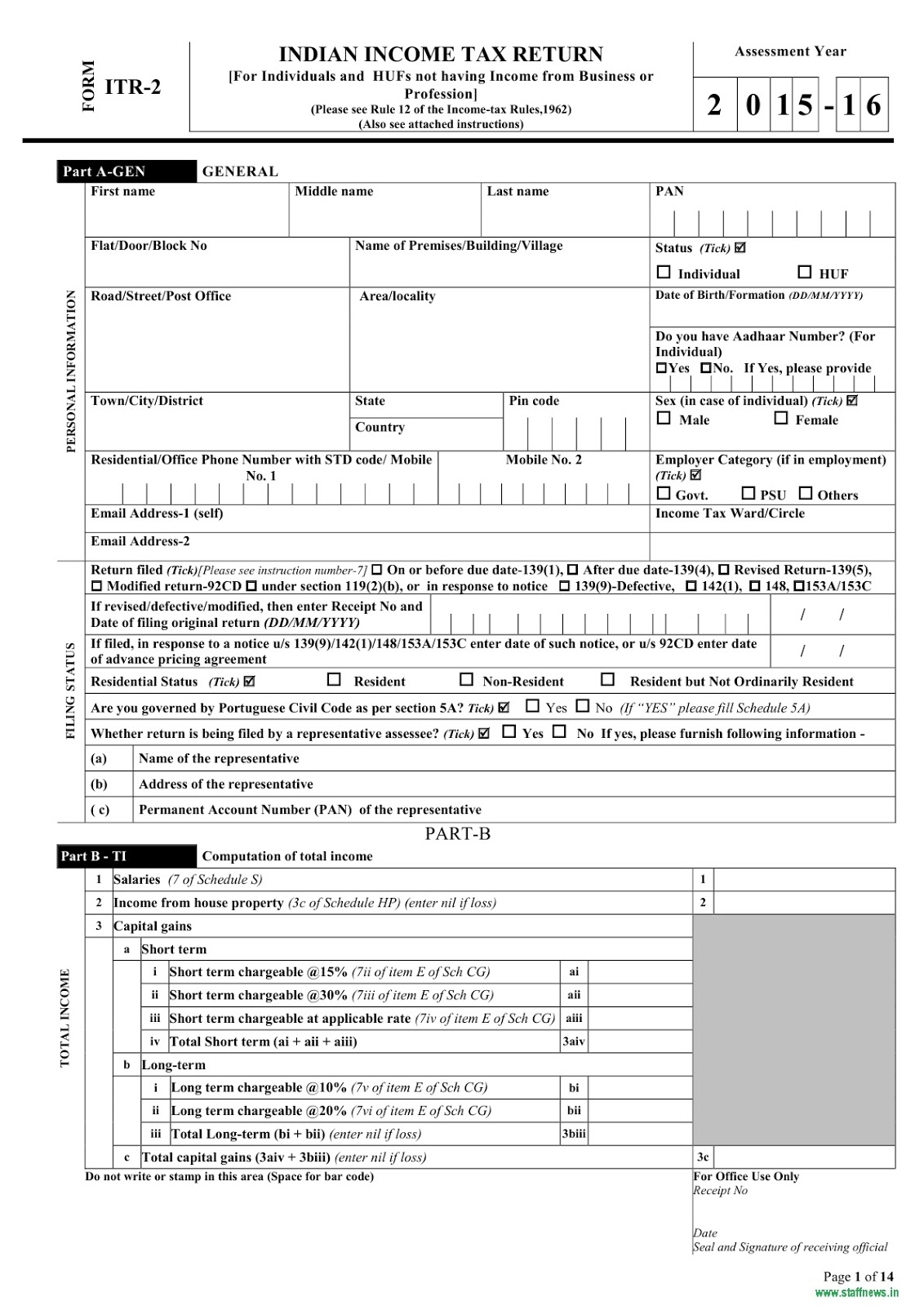

Taxable earnings are your earnings minus deductibles and fiscal schemes, such as costs made for your company or amortisations. The new Form 26AS which has been renamed as ‘Annual Information Statement’ and Form 26AS will be displayed on the TRACES portal in conjunction until the new AIS is verified and fully functioning.In the Netherlands, you pay income tax over your taxable earnings. On October 26, the Central Board of Direct Taxes (CBDT) released an order under Section 285BB of the Income Tax Act that disclosed additional information in the new Form 26AS. Taxpayers who have their active Permanent Account Number can get a copy of Form 26AS, which is an annual consolidated tax statement, on the e-Filing portal. No space is to be left between the letters to enter the password. Password to open the statement is your PAN number (in capital) followed by date of birth (in date-month-year format). Both these statements can be downloaded in PDF or JPEG form.The difference is that TIS contains information in summary form, whereas AIS contains information in detail. If you want, you can download both TIS and AIS as both contain almost the same information.After selecting the AIS option, a new tab will open in which two options will be given – Tax Information Summary (TIS) on the left side of the page and AIS will be written on the right side.You will see this option in the dropdown menu Here you have to go to the Services tab and select the option written AIS.First of all you have to go to Income Tax Department website and login here.

0 kommentar(er)

0 kommentar(er)